The agents of Barone Financial Group are proud to be certified to offer the Macro Asset Perspective® planning process. Through this unique educational approach, we can help you better prepare for retirement. Whatever stage of life you are in, whether you are working to grow your assets or your assets are working to provide your retirement income, you are likely to glean value from the principles, processes and strategies found in the Macro Asset Perspective®.

Introduction

Barone Financial Group financial professionals use a proprietary process called MAP, or Macro Asset Perspective®. In this process, our advisors deal with protection of assets, accumulation of wealth, building retirement income that cannot be outlived and leaving a lasting legacy.

The Process

During our process, first we introduce the scope of the work that we do and explain how New York Life provides products and services solutions to our clients. From there, we engage our clients in a Discovery process to uncover their objectives and current financial state. We then do a thorough Analysis of the Discovery Data and engage our team of professionals to develop a Summary Plan and Recommendations. We then Educate our clients as to their options and help them take Action to implement the plan. For many of our clients, they will then move from the MAP Foundations process to the full MAP, which more deals with the accumulation and placement of assets. Our goal is to develop lifetime partnerships with our clients to add value for them.

Our Role

In this process, we act as a Problem-Solving Coordinator for our clients. We interact with the client’s team of professionals, develop action items and follow-up on those items to ensure that the plan is implemented.

Digging Into the MAP

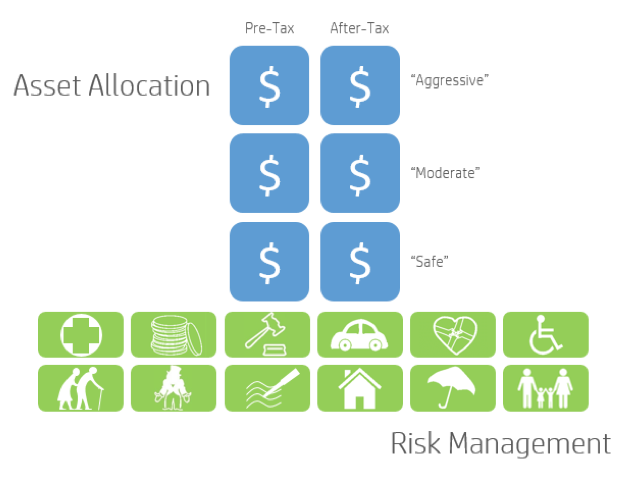

The 12 green boxes in the image to the right represent the foundation of risk management planning. From there, our certified MAP Advisors can create a more comprehensive asset allocation model of your current assets and cash flow.